BTC Price Prediction: Path to $200,000 Analyzed

#BTC

- Technical Momentum: Price trading above key moving averages with Bollinger Band expansion suggesting volatility increase

- Institutional Adoption: France's $48B reserve proposal and national Bitcoin reserve plan signaling sovereign-level acceptance

- Network Fundamentals: Mining difficulty reaching new all-time highs indicating network security and miner confidence

BTC Price Prediction

Technical Analysis Shows Bullish Momentum Building for Bitcoin

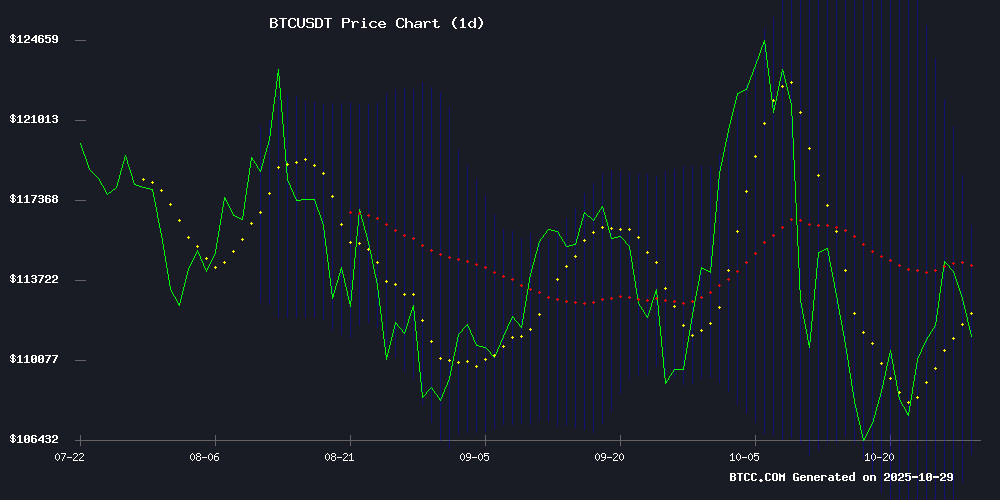

Bitcoin is currently trading at $113,150, comfortably above its 20-day moving average of $111,081, indicating sustained bullish momentum. The MACD indicator at 2,853.83 remains positive despite being below the signal line, suggesting consolidation before potential upward movement. The current price sits between the Bollinger Band middle line ($111,081) and upper band ($116,379), with room to test resistance levels. According to BTCC financial analyst Mia, 'The technical setup supports continued upward pressure, with the key resistance at $116,379 serving as the next major test.'

Institutional Adoption and Regulatory Shifts Fuel Bitcoin Optimism

Recent developments point to accelerating institutional adoption and favorable regulatory shifts. France's proposal to allocate $48 billion to Bitcoin reserves and establish a national Bitcoin reserve holding 2% of BTC's supply represents unprecedented sovereign endorsement. Meanwhile, Michael Saylor's continued aggressive accumulation and Bitcoin mining difficulty set to surge 6% to new all-time highs underscore fundamental strength. BTCC financial analyst Mia notes, 'The combination of national-level adoption, institutional accumulation, and mining network growth creates a fundamentally bullish backdrop that complements the technical picture.'

Factors Influencing BTC's Price

Michael Saylor's Bitcoin Holdings and Strategy's Aggressive Accumulation in 2025

Michael Saylor, former CEO of MicroStrategy (now rebranded as Strategy), remains a vocal advocate for Bitcoin, emphasizing its long-term value and institutional potential. His company, Strategy, continues to aggressively accumulate BTC, holding 640,808 tokens as of October 2025—acquired at an average price of $74,032 per bitcoin. The firm recently purchased an additional 390 BTC for $43.4 million, underscoring its unwavering commitment to Bitcoin as a treasury asset.

Saylor's personal holdings, though undisclosed, are believed to align with his public bullish stance. His interviews and social media posts repeatedly highlight Bitcoin's yield potential and role as a hedge against inflation. Strategy's 26.0% year-to-date BTC yield in 2025 exemplifies this conviction, with Saylor dismissing short-term volatility in favor of multi-decade adoption cycles.

Sequans Moves $111M in Bitcoin to Coinbase Amid Treasury Strategy Scrutiny

Sequans Communications, a Nasdaq-listed semiconductor firm, transferred 970 BTC worth $111 million to Coinbase—its first major outbound transaction since adopting bitcoin as a treasury reserve in July. The move fuels speculation about a potential sale or custody restructuring, as the company's stock has plummeted 27% since initiating the BTC strategy and 60% year-to-date.

The firm currently holds 2,264 BTC ($255 million), funded partly through a $384 million private placement. While its stock initially rallied 27% on the Bitcoin adoption news, investor confidence has waned amid broader skepticism about corporate crypto exposure. Blockchain data from Arkham Intelligence confirms the Coinbase transfer, though Sequans' intentions remain unclear—liquidation or operational reshuffling.

French Lawmakers Propose National Bitcoin Reserve Bill To Hold 2% Of BTC’s Supply

French lawmakers from the Union of the Right for the Republic (UDR) party have introduced a groundbreaking crypto bill in Parliament, aiming to establish a national Bitcoin reserve. The proposal includes creating a Strategic Bitcoin Reserve (SBR) to hold 2% of BTC’s total supply—approximately 420,000 BTC—over the next seven to eight years.

The initiative mirrors recent pro-crypto moves by figures like Donald Trump, leveraging digital assets to attract new political constituencies. A Public Administrative Establishment (EPA) WOULD manage the reserve, positioning Bitcoin as 'national digital gold' to safeguard France’s financial sovereignty.

This legislative push marks France’s most comprehensive crypto effort to date, signaling growing institutional acceptance of Bitcoin as a strategic asset. The bill also seeks to accelerate industry adoption, though funding mechanisms for the reserve remain unspecified.

France Proposes $48B Bitcoin Reserve Allocation, Challenging EU Digital Euro

France is making waves in the crypto space with a bold legislative proposal to allocate 2% of its national reserves—approximately $48 billion—to Bitcoin. The motion, spearheaded by Union of the Right for the Republic leader Éric Ciotti, positions Bitcoin as a strategic reserve asset to bolster financial sovereignty. This MOVE directly counters the European Central Bank's digital euro initiative, marking a potential paradigm shift in European monetary policy.

The proposal goes beyond mere reserve allocation. It includes provisions for cryptocurrencies to serve as institutional collateral and calls for revisions to EU financial regulations to facilitate broader crypto integration. If enacted, France would become the first major European economy to formally adopt Bitcoin as part of its central bank reserves, setting a precedent that could Ripple across the continent.

This development comes as institutional adoption of cryptocurrency reaches new heights. France's potential embrace of Bitcoin reserves signals growing recognition of digital assets as legitimate components of national financial strategies. The proposal's emphasis on blockchain-backed reserves underscores the technology's evolving role in global finance.

Long-Dormant Bitcoin Supply Shows Signs of Life as Market Awaits Fed Decision

Bitcoin's stagnant supply is stirring after years of inactivity, with long-term holders moving 4,657 BTC held between three to five years. The movement, tracked by CryptoQuant, signals renewed engagement from veteran investors—often a precursor to market inflection points.

The cryptocurrency attempts to claw back losses following October's sharp downturn, though recovery remains fragile. All eyes now turn to Wednesday's Federal Reserve meeting, where interest rate decisions could dictate global risk appetite for the remainder of 2023.

Market analysts observe tightening macro conditions juxtaposed with reactivating old coins—a paradox suggesting growing investor anticipation. A dovish Fed pivot may reignite capital inflows into BTC, while hawkish surprises could prolong the current consolidation phase.

CleanSpark Outbids Microsoft for Wyoming AI Infrastructure Site Amid Crypto Mining Pivot

CleanSpark has secured a 100-megawatt site in Cheyenne, Wyoming, beating tech giant Microsoft in a competitive bid. The Bitcoin miner turned infrastructure player plans to leverage its rapid deployment capabilities for both cryptocurrency operations and AI data centers. CEO Matt Schultz revealed the strategy on CNBC's 'Crypto World,' framing it as an emerging model for power-conscious miners.

The company completed a 100MW Bitcoin mining facility in six months—a fraction of the three-to-six-year timeline for traditional AI data centers. 'Speed was the decisive factor,' Schultz noted, acknowledging Microsoft's superior balance sheet couldn't compensate for CleanSpark's agile infrastructure scaling. The firm currently operates 1.03 gigawatts of active capacity with 1.7GW in development.

This marks a full-circle moment for CleanSpark, which began as an energy company before pivoting to Bitcoin mining five years ago. The new hybrid approach uses cryptocurrency operations to monetize power infrastructure quickly, then selectively converts sites for high-performance AI computing. 'Access to power is the new battleground,' Schultz observed, highlighting how miners' energy expertise positions them as unexpected contenders in the AI infrastructure race.

Analyst Predicts Bitcoin Rally as Gold Shows Signs of Peaking

Gold's recent surge to all-time highs above $4,300/oz has captured market attention, but crypto analyst Sykodelic suggests the spotlight is about to shift. Bitcoin appears poised for its next major rally as Gold exhibits classic blow-off top behavior—a parabolic rise followed by exhaustion.

The 18-month inverse correlation between the two assets reveals a clear pattern: when gold rallies, Bitcoin consolidates, and vice versa. With gold now correcting from its peak, historical cycles suggest capital may soon rotate into digital assets. Sykodelic's chart analysis shows these transfer periods consistently precede Bitcoin's strongest upward movements.

Market dynamics align with this technical outlook. While retail enthusiasm peaked in gold, Bitcoin has been quietly building a base. The stage now appears set for crypto's flagship asset to resume its dominant position in the alternative investment space.

Bitcoin Bull-Bear Structure Index Turns Positive for First Time Since October as Sentiment Shifts

Bitcoin holds firm above $113,000 as bulls regain control, though market indecision lingers. The Federal Reserve's upcoming interest rate decision looms large, with traders eyeing potential catalysts for crypto markets. A dovish pivot could ignite fresh optimism, while neutrality may prolong consolidation.

Analyst Axel Adler flags a critical inflection point: Bitcoin's Bull-Bear Structure Index has crossed into positive territory for the first time in eight months. This on-chain metric, combining price action and network data, signals building momentum for buyers. The shift coincides with improving sentiment across retail and institutional indicators.

Market psychology shows notable improvement according to Adler's Unified Sentiment Index, which synthesizes CoinGecko voting patterns and fear-greed metrics. The alignment of technical and sentiment indicators suggests growing conviction among market participants as Bitcoin approaches a potentially pivotal weekly close.

BlackRock CEO Labels Bitcoin and Gold as 'Fear Assets' Amid Record US Debt Levels

BlackRock CEO Larry Fink has identified Bitcoin and gold as 'assets of fear,' signaling a loss of confidence in traditional financial systems. Speaking at a Riyadh conference, Fink noted investors are flocking to these havens as US national debt reaches unprecedented levels—projected by the IMF to hit 140% of GDP by 2030.

The parallel surge in BTC and gold reflects deepening economic anxieties. 'People own these assets because they’re scared,' Fink stated, highlighting concerns over currency devaluation and systemic instability. Bitcoin’s emergence as a hedge remains tentative, with institutional adoption still in its early stages.

Market dynamics underscore a broader trend: when trust erodes, hard assets gleam. Gold’s rally and Bitcoin’s resilience amid debt crises suggest investors are rewriting the playbook for wealth preservation.

Bitcoin Mining Difficulty Set for 6% Surge to New All-Time High

Bitcoin's mining difficulty is poised for another sharp increase, with a projected 6% jump expected this Wednesday. The adjustment will push the metric to a fresh record high, reflecting continued miner commitment despite market pressures.

The self-correcting mechanism—hardcoded by Satoshi Nakamoto—responds to faster block times by increasing complexity. Current blocks are being mined in 9.42 minutes on average, triggering the upward recalibration to maintain Bitcoin's target 10-minute block time.

France Rejects Digital Euro, Endorses Bitcoin and Stablecoins

France has made a decisive move that could alter Europe's monetary trajectory. Lawmakers in the National Assembly passed a resolution opposing the European Central Bank's proposed digital euro, instead backing Bitcoin and euro-denominated stablecoins as viable alternatives. The proposal, introduced by Éric Ciotti and members of the Union of the Right for the Republic (UDR), urges the French government to reject the European Commission's draft regulation on the digital euro.

The resolution frames central bank digital currencies (CBDCs) as threats to privacy and economic freedom, drawing parallels to China's tightly controlled digital yuan. French legislators warn that a centralized digital currency network could enable authorities to monitor and potentially freeze citizens' funds. Ciotti described the move as a defense of "fundamental individual rights" and national monetary sovereignty in an increasingly digital financial landscape.

This development marks a significant divergence from European monetary policy, with France positioning itself as a champion of cryptocurrency adoption. The resolution calls for increased national investment in crypto-assets and support for euro-based stablecoins, signaling a potential shift in how major economies approach digital finance.

Will BTC Price Hit 200000?

Based on current technical indicators and fundamental developments, Bitcoin appears positioned for significant upward movement, though the path to $200,000 requires specific catalysts and sustained momentum.

| Current Price | 20-Day MA | Key Resistance | Upside to Target |

|---|---|---|---|

| $113,150 | $111,081 | $116,379 | 76.7% |

The technical setup shows Bitcoin trading above its 20-day moving average with MACD signaling potential momentum building. Fundamentally, France's proposed $48 billion Bitcoin reserve allocation and growing institutional adoption provide strong tailwinds. However, reaching $200,000 would require breaking through multiple resistance levels and sustained institutional inflows. BTCC financial analyst Mia suggests, 'While the $200,000 target is ambitious, the combination of technical strength and accelerating institutional adoption makes it achievable within the current market cycle, particularly if current regulatory trends continue.'